Llp Contract Template

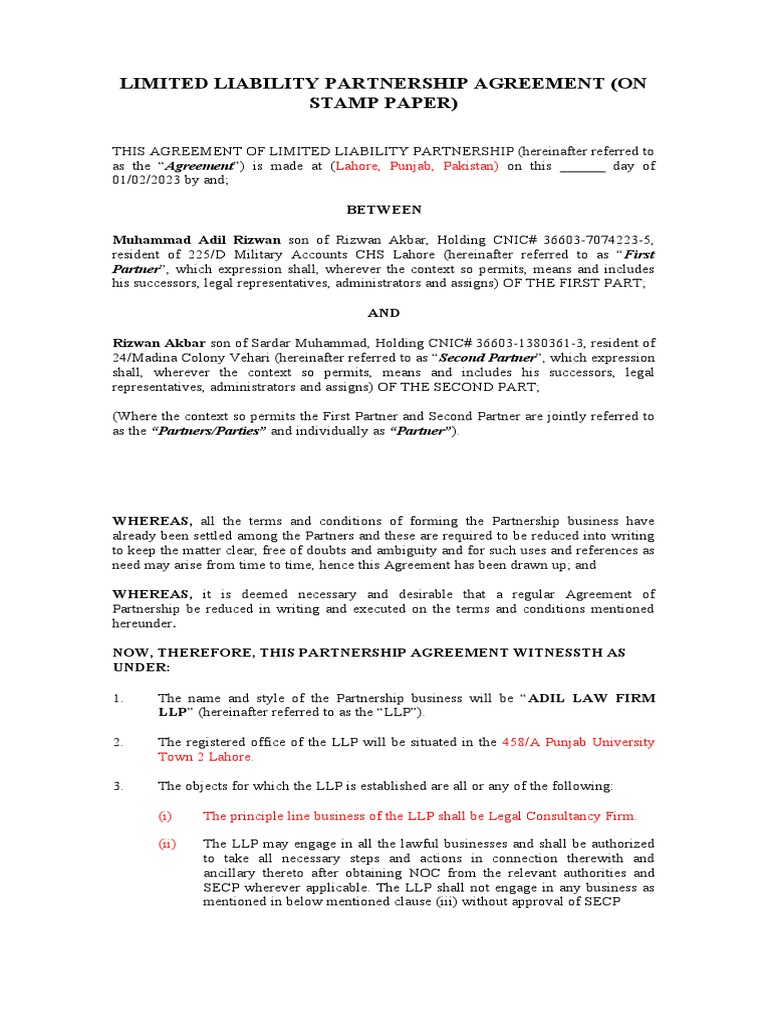

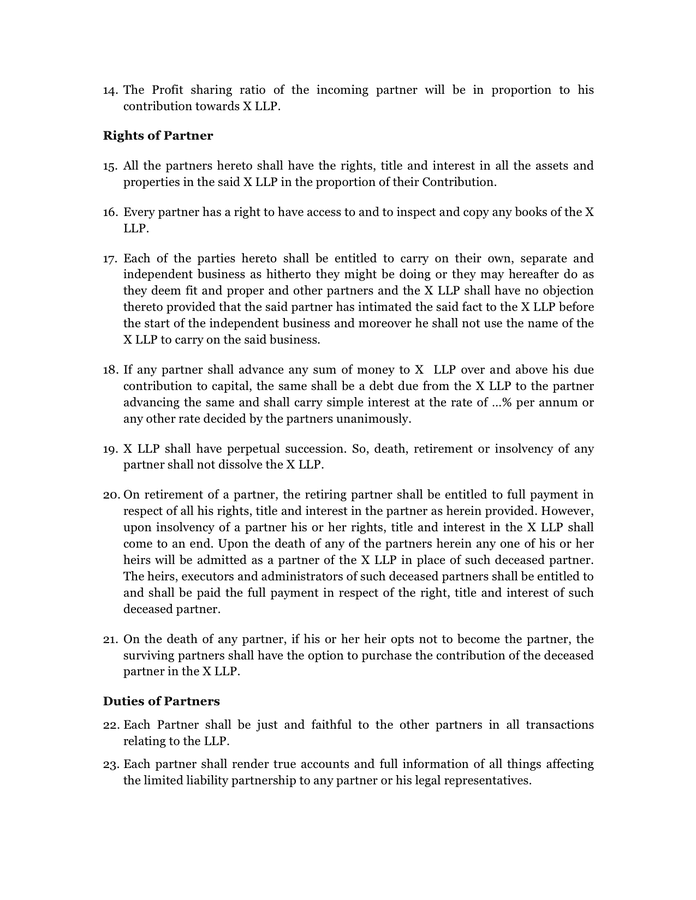

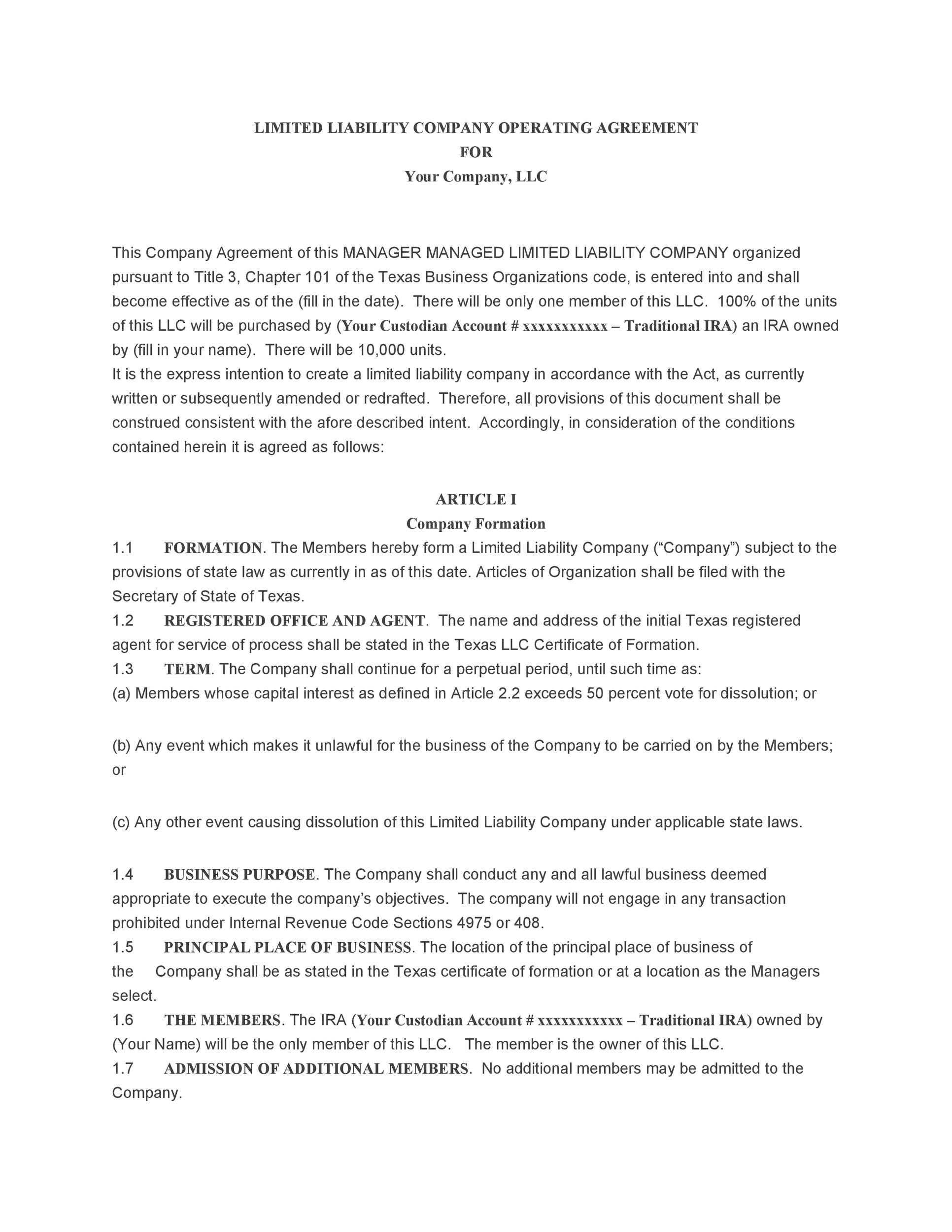

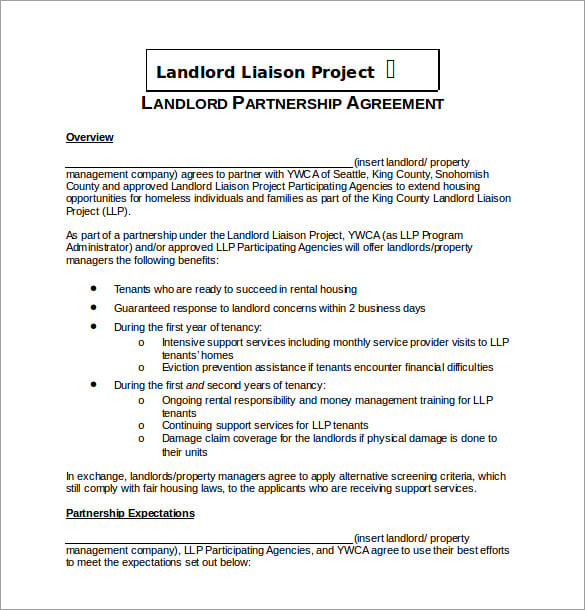

Llp Contract Template - Partners in an llp aren't liable for the. Limited partnerships (lps) and limited liability partnerships (llps) are both businesses with more than one owner, but unlike general partnerships, limited partnerships. As a result, there are key differences between how. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. Since the 1990s, a limited liability partnership (llp) has become a popular form of business organization for many licensed professionals, such as: Each business partner is provided with limited liability, which means they aren't fully responsible for the business' debts or liabilities. What is a limited liability partnership? A limited liability partnership (llp) is formed by two or more individuals who desire to conduct business for profit. An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a. What is a limited liability partnership (llp)? A limited liability partnership (llp) is formed by two or more individuals who desire to conduct business for profit. Like most other types of partnership or company, an llp structure provides plenty of flexibility for how the business will operate on a daily basis. Choosing the right business entity is important for your tax implications and legal recognition in your state of operation, as well as the protection of your personal assets as a. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business. Limited partnerships (lps) and limited liability partnerships (llps) are both businesses with more than one owner, but unlike general partnerships, limited partnerships. Here are some of main features. Since the 1990s, a limited liability partnership (llp) has become a popular form of business organization for many licensed professionals, such as: What is a limited liability partnership (llp)? An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a. As a result, there are key differences between how. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business. Like most other types of partnership or company, an llp structure provides plenty of flexibility for how the business will operate on a daily basis. Choosing the right business entity is important for your tax implications and. An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a. What is a limited liability partnership? In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. A limited liability partnership (llp) is formed by two or more. Choosing the right business entity is important for your tax implications and legal recognition in your state of operation, as well as the protection of your personal assets as a. A limited liability partnership (llp) is formed by two or more individuals who desire to conduct business for profit. Limited liability partnerships (llps) allow for a partnership structure where each. An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a. What is a limited liability partnership (llp)? Since the 1990s, a limited liability partnership (llp) has become a popular form of business organization for many licensed professionals, such as: Limited liability partnerships (llps) allow for a partnership structure where. Limited partnerships (lps) and limited liability partnerships (llps) are both businesses with more than one owner, but unlike general partnerships, limited partnerships. Choosing the right business entity is important for your tax implications and legal recognition in your state of operation, as well as the protection of your personal assets as a. What is a limited liability partnership? Since the. What is a limited liability partnership (llp)? Each business partner is provided with limited liability, which means they aren't fully responsible for the business' debts or liabilities. As a result, there are key differences between how. Since the 1990s, a limited liability partnership (llp) has become a popular form of business organization for many licensed professionals, such as: Limited partnerships. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. Partners in an llp aren't liable for the. Each business partner is provided with limited liability, which means they aren't fully responsible for the business' debts or liabilities. A limited liability partnership (llp) is formed by two or. Limited partnerships (lps) and limited liability partnerships (llps) are both businesses with more than one owner, but unlike general partnerships, limited partnerships. Like most other types of partnership or company, an llp structure provides plenty of flexibility for how the business will operate on a daily basis. What is a limited liability partnership (llp)? Here are some of main features.. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they put into the business. Here are some of main features. Like most other types of partnership or company, an llp structure provides plenty of flexibility for how the business will operate on a daily basis. As a result, there are key. Choosing the right business entity is important for your tax implications and legal recognition in your state of operation, as well as the protection of your personal assets as a. An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a. A limited liability partnership (llp) is formed by two. Limited partnerships (lps) and limited liability partnerships (llps) are both businesses with more than one owner, but unlike general partnerships, limited partnerships. Since the 1990s, a limited liability partnership (llp) has become a popular form of business organization for many licensed professionals, such as: What is a limited liability partnership (llp)? Choosing the right business entity is important for your tax implications and legal recognition in your state of operation, as well as the protection of your personal assets as a. Partners in an llp aren't liable for the. A limited liability partnership (llp) is formed by two or more individuals who desire to conduct business for profit. Like most other types of partnership or company, an llp structure provides plenty of flexibility for how the business will operate on a daily basis. What is a limited liability partnership? Here are some of main features. Each business partner is provided with limited liability, which means they aren't fully responsible for the business' debts or liabilities. An llp is a form of business organization that has become popular among entrepreneurs as it gives the benefits of a.LLP Agreement Template PDF Law Limited Liability Partnership

Draft LLP Agreement PDF

llp agreement sample malaysia Jennifer Wallace

Llp Partnership Agreement Template

Llp Agreement Template

Llp Operating Agreement Template

Llp Partnership Agreement Template Template 2 Resume Examples

Llp Partnership Agreement Template Free Uk PDF Template

Llp Agreement Template PDF Template

Llp Partnership Agreement Template Template 2 Resume vrogue.co

In Basic Terms, The Owners Of An Llp Are Considered Partners In An Organization, While The Owners Of An Llc Are Members.

Limited Liability Partnerships (Llps) Allow For A Partnership Structure Where Each Partner’s Liabilities Are Limited To The Amount They Put Into The Business.

As A Result, There Are Key Differences Between How.

Related Post: