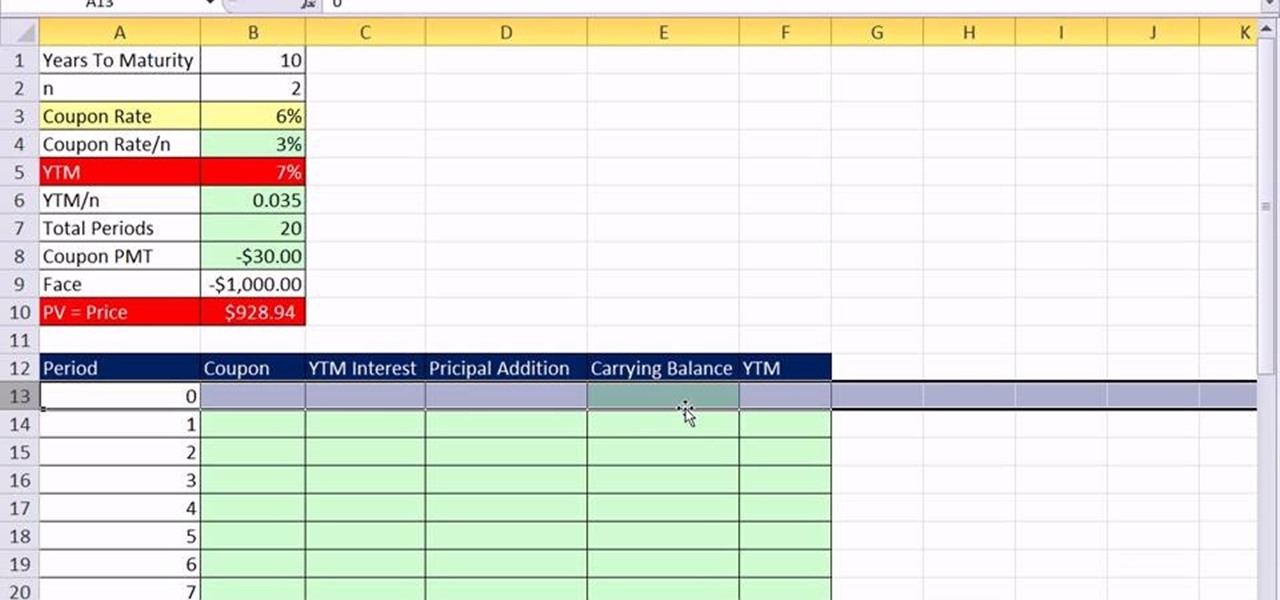

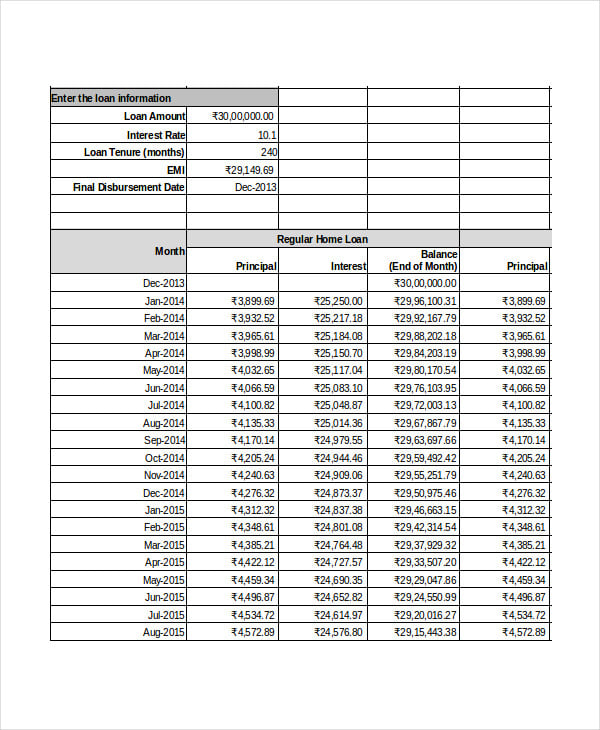

Amortisation Table Excel Template

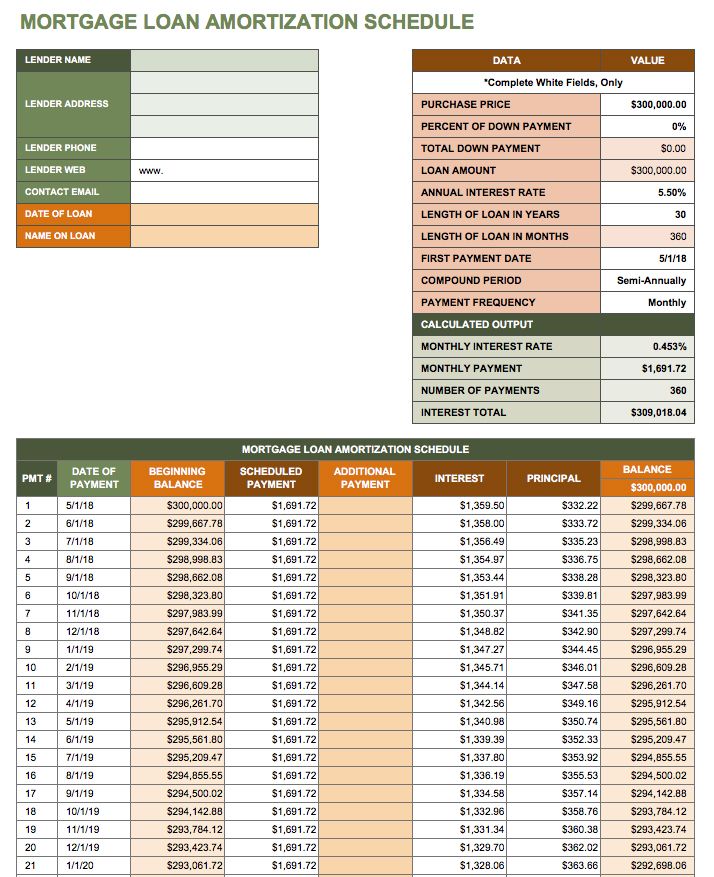

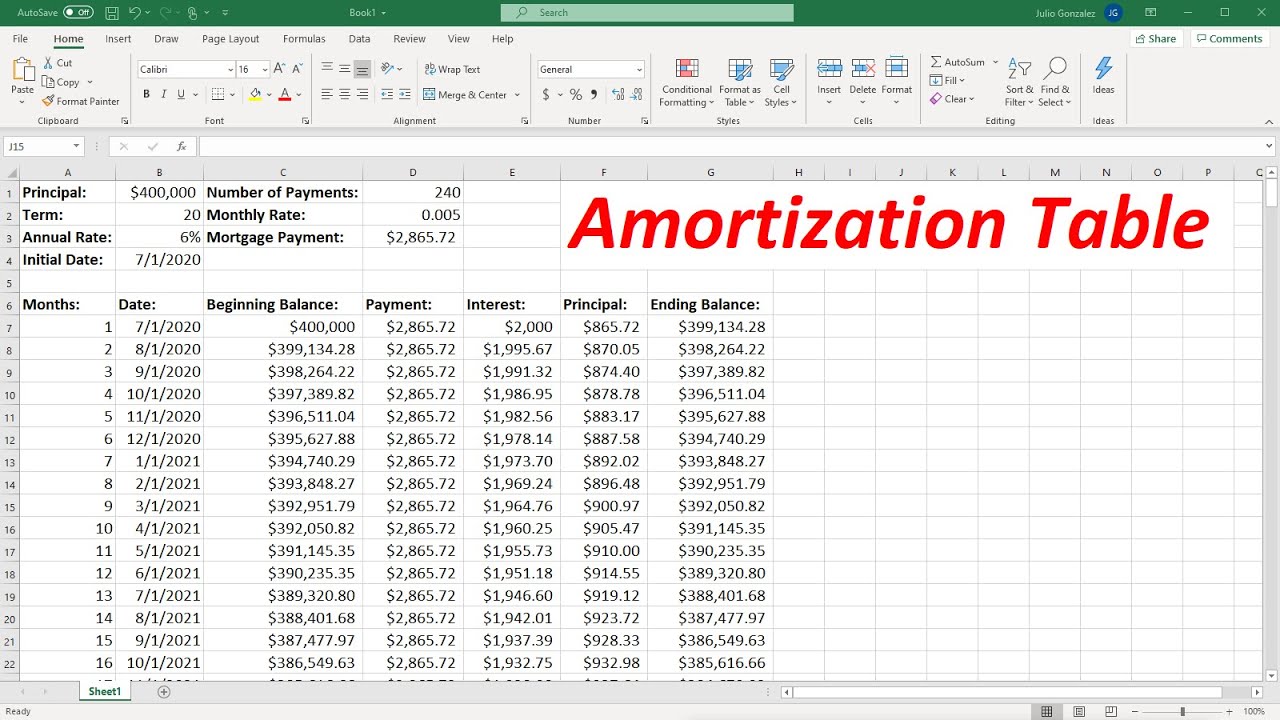

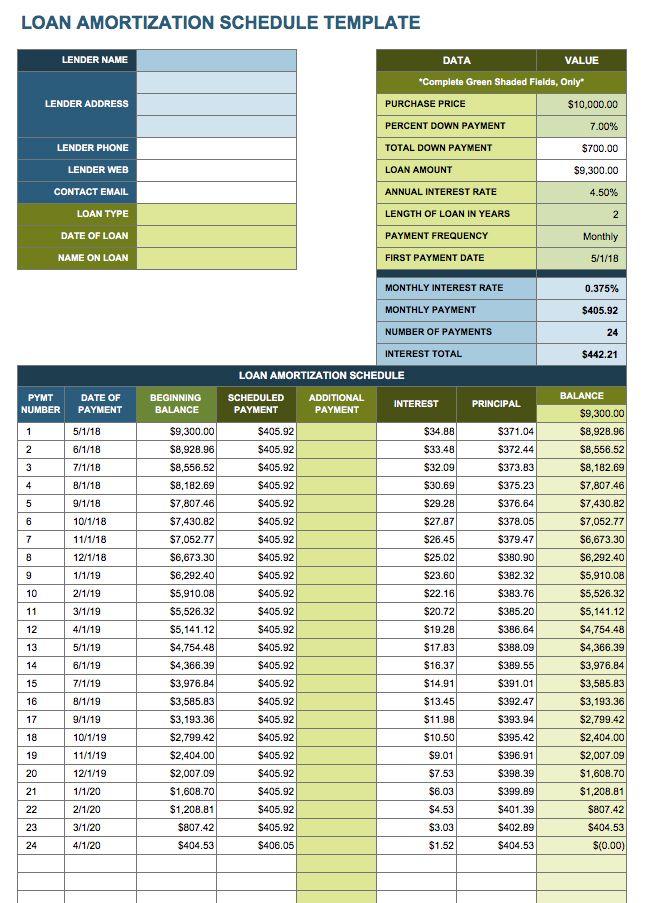

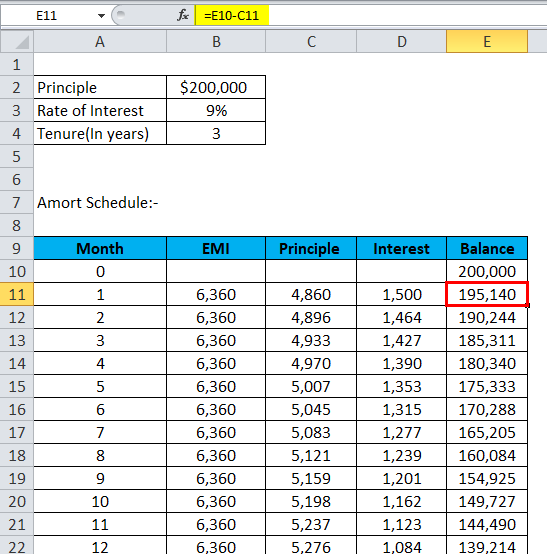

Amortisation Table Excel Template - In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. It refers to the process of spreading out the cost of an asset over a period of time. Amortization and depreciation are two main methods of calculating the value of these assets whether they're company vehicles, goodwill, corporate headquarters, or patents. This can be useful for. It aims to allocate costs fairly, accurately, and systematically. Explore examples, methods, and its impact on financial statements. Amortization is a term that is often used in the world of finance and accounting. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time. The first is the systematic repayment of a loan over time. Amortization refers to the process of spreading out the cost of an intangible asset or capital expenditure over a specific period, typically for accounting or tax purposes. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, reflecting its consumption. It aims to allocate costs fairly, accurately, and systematically. There are two general definitions of amortization. The first is the systematic repayment of a loan over time. It refers to the process of spreading out the cost of an asset over a period of time. The second is used in the context of business accounting and is the act of. Amortization is a term that is often used in the world of finance and accounting. This can be useful for. Explore examples, methods, and its impact on financial statements. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, reflecting its consumption. Amortization is a systematic. This can be useful for. It refers to the process of spreading out the cost of an asset over a period of time. It aims to allocate costs fairly, accurately, and systematically. The first is the systematic repayment of a loan over time. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible. Explore examples, methods, and its impact on financial statements. Amortization is a term that is often used in the world of finance and accounting. The first is the systematic repayment of a loan over time. It is comparable to the depreciation of tangible assets. Amortization is the process of incrementally charging the cost of an asset to expense over its. Amortization and depreciation are two main methods of calculating the value of these assets whether they're company vehicles, goodwill, corporate headquarters, or patents. Amortization is a term that is often used in the world of finance and accounting. The second is used in the context of business accounting and is the act of. It refers to the process of spreading. There are two general definitions of amortization. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time. It refers to the process of spreading out the cost of an asset over a period of time. It is comparable to. There are two general definitions of amortization. Amortization refers to the process of spreading out the cost of an intangible asset or capital expenditure over a specific period, typically for accounting or tax purposes. It aims to allocate costs fairly, accurately, and systematically. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. Amortization. The first is the systematic repayment of a loan over time. Amortization is a term that is often used in the world of finance and accounting. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. Amortization and depreciation are two main methods of calculating the value of these assets whether they're company vehicles,. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, reflecting its consumption. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time. In accounting, amortization refers to the. It is comparable to the depreciation of tangible assets. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, reflecting its consumption. Amortization refers to the process of spreading out the cost of an intangible asset or capital expenditure over a specific period, typically for accounting or tax purposes. In. Amortization is the process of incrementally charging the cost of an asset to expense over its expected period of use, reflecting its consumption. There are two general definitions of amortization. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. The second is used in the context of business accounting and is the act. Amortization refers to the process of spreading out the cost of an intangible asset or capital expenditure over a specific period, typically for accounting or tax purposes. Amortization and depreciation are two main methods of calculating the value of these assets whether they're company vehicles, goodwill, corporate headquarters, or patents. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. This can be useful for. Explore examples, methods, and its impact on financial statements. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. It is comparable to the depreciation of tangible assets. Amortization is a term that is often used in the world of finance and accounting. The second is used in the context of business accounting and is the act of. It refers to the process of spreading out the cost of an asset over a period of time. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time.Amortisation Schedule Excel Template

Amortisation Schedule Excel Template

Amortisation Schedule Excel Template

Amortisation Schedule Excel Template

Amortisation Schedule Excel Template

Amortisation Schedule Excel Template

Free Amortisation Schedule Templates For Google Sheets And Microsoft

Amortisation Schedule Excel Template

Best Excel Amortisation Schedule Template Call Center Scheduling For

Amortisation Schedule Excel Template

Amortization Is The Process Of Incrementally Charging The Cost Of An Asset To Expense Over Its Expected Period Of Use, Reflecting Its Consumption.

The First Is The Systematic Repayment Of A Loan Over Time.

It Aims To Allocate Costs Fairly, Accurately, And Systematically.

There Are Two General Definitions Of Amortization.

Related Post: