501 C 3 Forms Template

501 C 3 Forms Template - For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales. Section 501 (c) (3) of the tax code is the section that describes charitable organizations that are exempt from paying federal income tax, including churches. Such organizations are exempt from some. What is a 501 (c) (3) nonprofit? These include entities organized and. Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Specifically, it identifies which nonprofit. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Section 501 (c) (3) of the tax code is the section that describes charitable organizations that are exempt from paying federal income tax, including churches. Organizations described in section 501 (c) (3), other than testing for. For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales. Learn everything you need to know about nonprofit status in this guide! Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. Such organizations are exempt from some. What is a 501 (c) (3) nonprofit? Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Such organizations are exempt from some. For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the. Learn everything you need to know about nonprofit status in this guide! Specifically, it identifies which nonprofit. Organizations described in section 501 (c) (3), other than testing for. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. What is a 501 (c) (3) nonprofit? A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. What is a 501 (c) (3) nonprofit? Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. Specifically, it identifies which nonprofit. Section 501 (c) (3) of. For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Organizations described in section 501. For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales. Learn everything you need to know about nonprofit status in this guide! What is a 501 (c) (3) nonprofit? Organizations described in section 501 (c) (3) are commonly. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. These include entities organized and. Learn everything you need to know about nonprofit status in this guide! Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different. What is a 501 (c) (3) nonprofit? A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. Organizations described in section 501 (c) (3), other than testing. These include entities organized and. Organizations described in section 501 (c) (3), other than testing for. Specifically, it identifies which nonprofit. Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. Such organizations are exempt from some. Specifically, it identifies which nonprofit. Explore levi's® 501® jeans for men, the iconic. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Explore levi's® 501® jeans for men, the iconic denim with. Organizations described in section 501 (c) (3) are commonly referred to as charitable organizations. These include entities organized and. Section 501 (c) (3) of the tax code is the section that describes charitable organizations that are exempt from paying federal income tax, including churches. For purposes of clause (i), the term “ load loss transaction ” means any wholesale or retail sale of electric energy (other than to members) to the extent that the aggregate sales. A 501 (c) organization is a nonprofit organization in the federal law of the united states according to internal revenue code (26 u.s.c. Specifically, it identifies which nonprofit. Many people think that 501 (c) and 501 (c) (3) means the same thing, but they are actually two different tax categories in the internal revenue code. Explore levi's® 501® jeans for men, the iconic denim with a straight fit and timeless style, perfect for any occasion. Learn everything you need to know about nonprofit status in this guide!Printable 501c3 Application Printable Application

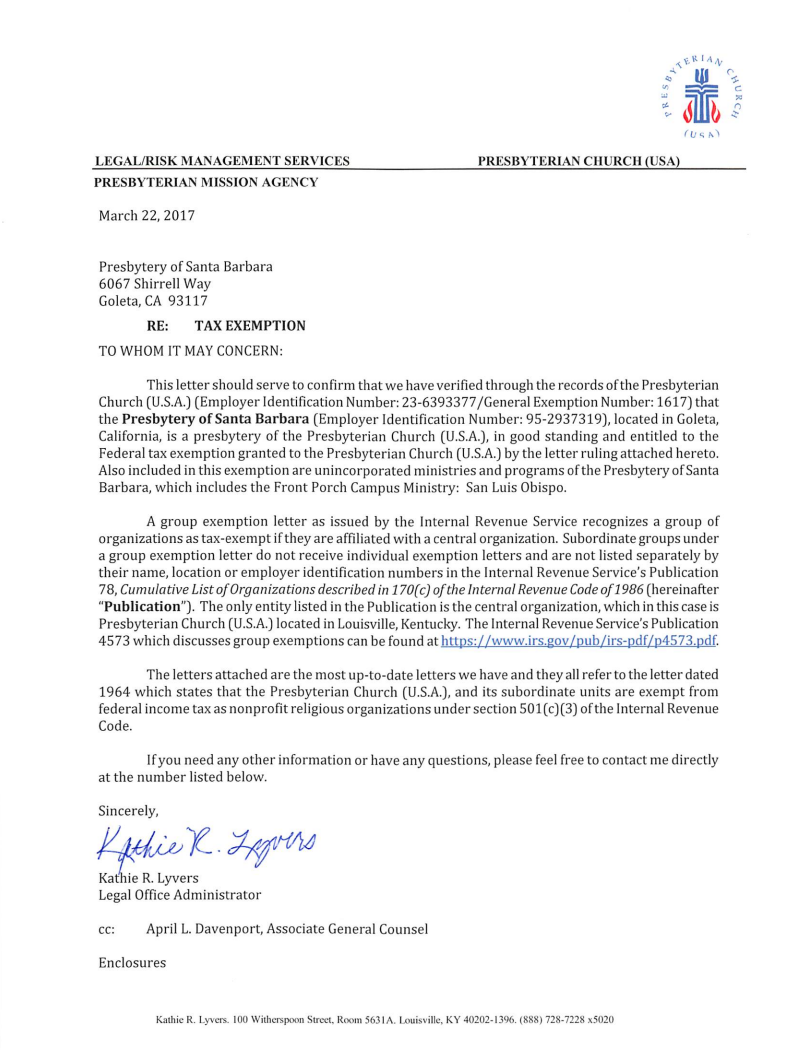

501(c)(3) Status — Front Porch

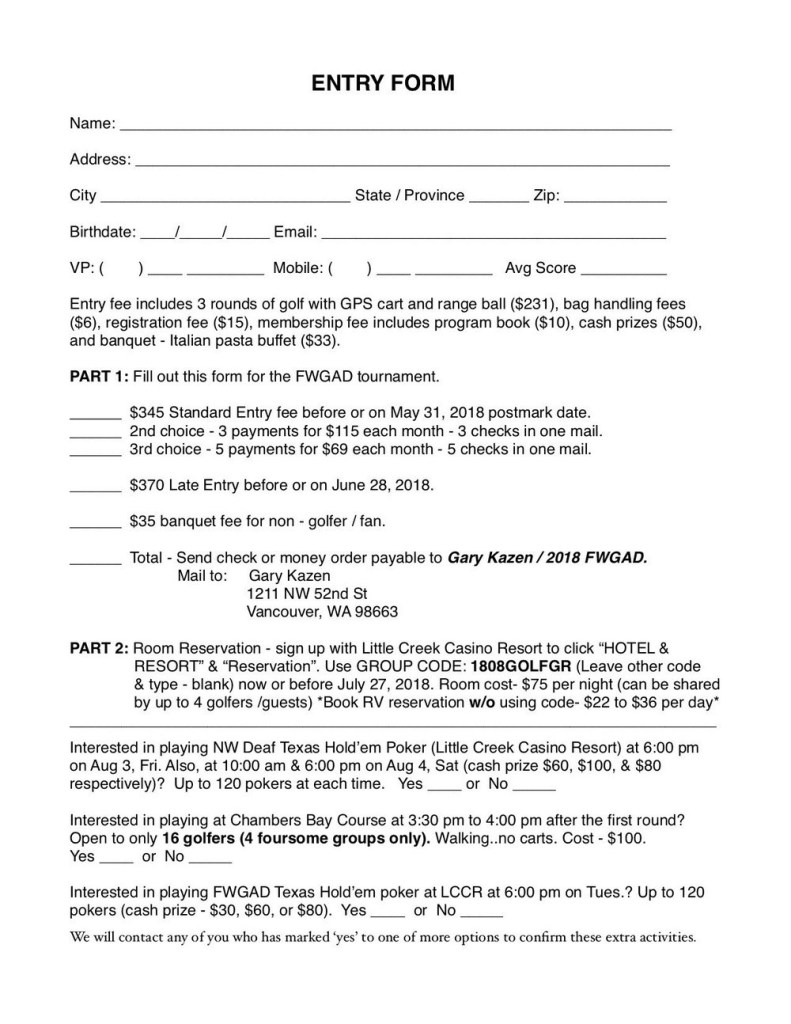

Application For 501c3 Free Printable Forms Printable Forms Free Online

501C3 Application ≡ Fill Out Printable PDF Forms Online

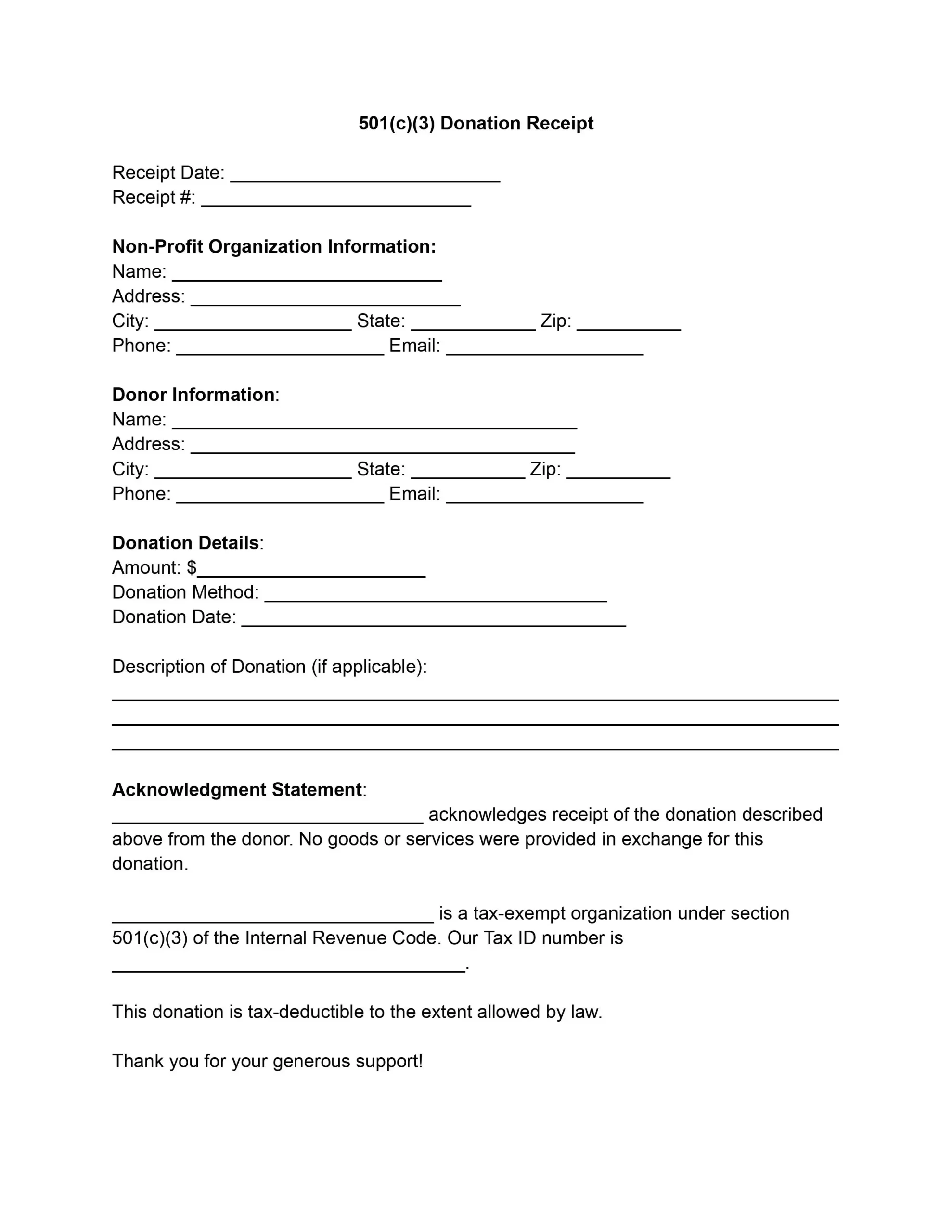

A 501c3 donation receipt template is mostly used by a nonprofit

Printable 501c3 Form Printable Forms Free Online

501(c)(3) Donation Receipt ≡ Fill Out Printable PDF Forms

501c3 Donation Receipt Template Printable in Pdf, Word Receipt

501c3 Donation Receipt Template Printable pdf & Word pack Etsy

501c3 Template Etsy

What Is A 501 (C) (3) Nonprofit?

Such Organizations Are Exempt From Some.

Organizations Described In Section 501 (C) (3), Other Than Testing For.

Related Post:

(3)+form.png)